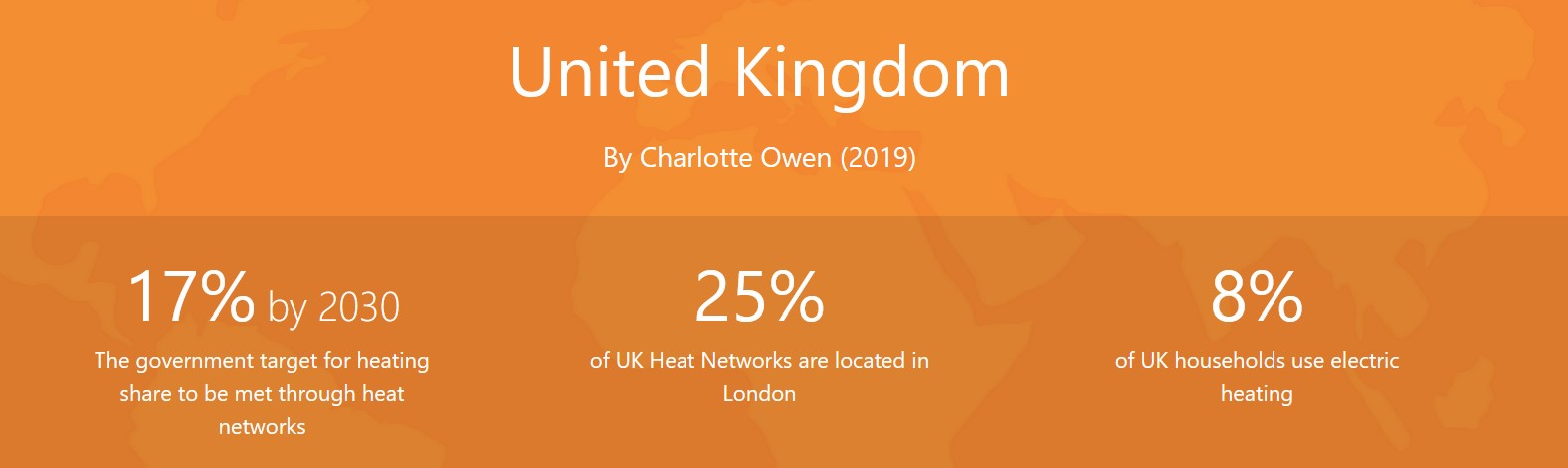

The UK heat networks market is currently relatively small compared to the heat networks market in mainland Europe, however, the market is set to grow. The UK Government has set a target for 17% of UK heating needs to be met through heat networks by 2030. Over the past 5 years, interest in the UK heat networks market from domestic and foreign developers and investors has increased. Nevertheless, investment in the UK heat network market remains relatively low, with high internal rates of return needed and a perceived high level of risk. The forthcoming introduction of regulation for the heat networks market should help to level off this perceived risk and increase investment in the UK heat networks market.

Across the UK, some local authorities have used local development plans, concessions or zoning to direct heat network development. Scotland, in particular, has used heat network zoning to encourage the development of heat networks. London, which has some devolved powers, has also used planning policy to direct heat network development in the city to the point that 25% of UK heat networks are in London.

Currently, the lack of regulation for the heat networks sector is a key barrier to the expansion of the UK heat networks market. At present, unlike other energy generation and infrastructure, heat networks do not benefit from a regulated investment framework to help bring down the costs of investment.

This lack of regulation has also meant that heat network consumers pay higher taxes than consumers of other energy sources. For example, heat network consumers pay business rates of approximately £100 per year, whereas consumers of gas pay around £3. Heat network consumers may also pay EU ETS, unlike consumers using an individual gas boiler system.

During the period 2012-2017, CHP in the UK has generally seen a worsening policy context. In 2014, the Government commissioned a report on the usefulness of introducing a bespoke CHP policy. This was ultimately not taken forward as it was felt that existing policy and economics were sufficient. The following year, in 2015, Levy Exemption Certificates were removed – taking away a significant form of revenue for CHP. More recently, the UK has significantly reformed its network charges framework which has eroded the benefits that on-site and distribution-connected CHP could earn. This process is continuing and likely to result in further erosion.

Otherwise, during the period 2012-2017, CHP policy has remained relatively stable or positive. The CHP Quality Assurance scheme remains in place and provides incentives to Good Quality CHP. The Capacity Market was introduced in 2014 and provides significant revenue to large-scale CHP over 2 MW or aggregated smaller sites. This was suspended in 2018 following a legal challenge at EU-level but the Government remains hopeful it will be reinstated

If you would like to learn more, you can purchase the latest Country by Country Survey.

Useful links:

The Association for Decentralised Energy (The ADE)